0 Preface

In late 2020, tired of my old Brooklyn apartment – historic and charming, but loud and full of maintenance hassles – I put my co-op unit on the market and set out to buy a new condo. Common charges for apartments in New York City can be as high as rent in other cities, so I knew that I wanted to buy a walk-up. Soon after, I found an efficient little one-bedroom, one-bath in a new five-story walk-up building on a 2,000-sq. ft. lot. Technically an older building from the early 20th century with two new added floors, the plans were filed under an older New York City building code, and so the developer got away with not installing an elevator. The price was double the median sales price for a new house in the United States, but the common charges were only $226 per month – not particularly low by, say, Swiss or French standards, but very affordable for New York City. I was an in-shape 32-year-old, and had only ever lived in walk-ups in New York. An elevator just seemed like an unnecessary cost.

Almost as soon as I moved in, I would come to regret the decision. In 2017, after a routine viral infection, I had never felt quite right. Doctors dismissed my complaints of fatigue, constant thirst, and a strange tingling in my arms, and eventually I gave up looking for answers and dismissed them too. But in the spring of 2021, shortly after moving in, my health took a sharp turn for the worse. Riding a bike across the Williamsburg Bridge one morning to work, my vision almost went dark. I began to feel dizzy every time I stood up or ate. A few times, I fainted. A doctor would soon diagnose me with postural orthostatic tachycardia syndrome, a disease that often starts with a viral infection, on top of the myalgic encephalomyelitis (commonly, and sometimes derisively, called chronic fatigue syndrome) that, in retrospect, no doctor had been willing to diagnose years prior.

My walk-up apartment quickly began to feel like a trap. Despite still being in good shape, I would get dizzy and winded walking up the two flights of stairs to my unit. My doctors advised me to limit exertion and stop exercising. I began to order delivery from a restaurant that was just across the street. Walking wasn’t so bad, but the stairs were a barrier to leaving my home.

That next Christmas, I traveled to Romania to see my mother. While I was in Europe, a Minneapolis developer’s tweet about a new 12-unit apartment building he’d developed went viral. It read, “12 units. Single-family lot. No elevator. No parking. Minneapolis.” His intent was to show how it’s still possible to build an affordable building in an American city by paring it down to the basics.

Urbanists and his fellow developers on Twitter were complimentary (the rents were remarkably low for new, unsubsidized construction), but eventually the tweet escaped those circles and the reactions were vicious. “Do you think disabled people don’t live in Minnesota?” “Wait. How is it legal to build new housing without an elevator?” “God forbid an able-bodied tenant gets into an accident or becomes disabled.” “Real estate developers will not see heaven.” “Fuck off if you have kids. Fuck off if you’re disabled. Fuck off if you become disabled.”

As a newly disabled person, I got it. But as somebody who knew something about real estate development, I thought, have these people never seen a three-story apartment building in their own country? None of them have elevators. It’s not affordable to spend $100,000 or more (plus recurring expenses) on an elevator that only serves eight apartments.

But then I thought about the continent where I was lying, in bed, reeling from the aftereffects of trying to walk for a few miles with an energy-limiting illness. Almost all new apartment buildings in Western Europe have elevators. My mother’s building in Bucharest, a city dramatically poorer than Minneapolis, has 15 apartments and an elevator. My friend in Rome, who lives in a building shorter than mine, has not one but two elevators (the design is such that the developer could have gotten away with only one, but since the building had 12 apartments, they decided to split it into two slightly separated wings for aesthetic purposes). I asked an Italian architect I knew how much an elevator there would cost to install in a mid-rise apartment building. Not more than the low tens of thousands of euros, he said – a tiny fraction of the cost of an elevator in America.

Americans pride ourselves on our accessibility laws. Traveling in Amsterdam, Paris, or London on vacation, all you see as a tourist are inaccessible, old walk-up buildings. The people are thinner, but you rarely see people in wheelchairs rolling down the sidewalk. In American architecture and building code circles, you often hear some variation on, “they don’t have the ADA in Europe.” (Very true – the ‘A’ stands for Americans.) And while it is true that in the United States you are more likely to see certain accessibility features than in Europe, the truth about disability and access is more complicated.

With an intensive regimen of off-label medications and a lot of luck, my health has improved. The stairs in my building are now manageable, though deterioration remains a constant threat. When my friend in Rome with two elevators in her 12-unit, four-story building came to see me in New York a few months later, she panted as she lugged her suitcase up the final step. I apologized for not being able to help her, given my limited energy. She said that’s alright, but asked, “You Americans love these buildings without elevators, why is that?” This report seeks to answer that question, and propose how North America can join the rest of the developed world and learn to love the elevator again. Because while many of us may be stair users for the moment, we’re all born disabled and, with any luck, we will die disabled as well.

1 Introduction

The United States of America is a sprawling, car-centric country, but one form of mass transit stands out above the rest in sheer ridership: the elevator. The earliest elevators date back to antiquity, but it was in the mid-1800s that technological advances and urban trends came together to create the elevator and elevator industry that we know today. Its center was in New York City, where the elevator made the leap from hotels and stores to the office building in 1869, with the construction of the Equitable Building. The elevator allowed Lower Manhattan to pierce through the de facto five-story height limit imposed by humans’ willingness to climb stairs and, along with steel frame construction, led to the invention of the skyscraper, changing the skylines of American cities before conquering the rest of the planet.1

Americans make over 20 billion trips per year by elevator – twice the number of trips made by what people think of as mass transit. Despite the association between elevators and high-rises, the average elevator in the United States only has four landings, with elevators being as much a tool for convenience and accessibility as for able-bodied necessity.2 The elevator – along with its lesser-used diagonal cousin, the escalator – makes up an entire axis of mechanized travel.

When elevators were first popularized in the 19th and early 20th centuries, they were found mostly in taller buildings. A mid-rise property of public significance like a hotel or office building might have one, but otherwise, they were too expensive for an apartment building of just a few stories, particularly back when they required a full-time human operator. But since World War II, the trend in Western Europe (and, later, East Asia) has been to install elevators not only in buildings that absolutely need them given their height, but in any new apartment building at all – and many older ones too. They’ve become as routine in high-income countries in Western Europe and East Asia as a washing machine or parking space, and moving into a building with an elevator has become a normal part of the aging process.

But despite being the birthplace of the modern passenger elevator, the United States has fallen far behind its peers. Elevators in the United States have remained a fairly niche item in residential settings – expected in a high-rise or a big new mid-rise apartment building, but otherwise largely absent from the middle-class home. Part of this absence is due to the dominance of freestanding single-family houses in North America, but even apartments in the United States are less likely to have elevators than those in much of Europe and Asia. The United States relies heavily on walk-up typologies like townhouses and garden apartment complexes for infill and multifamily development. In absolute terms, the United States has fewer elevators than Spain – a country with one-seventh the population, and fewer than half the number of apartments. With rapidly aging populations, countries from China to Croatia have embarked on ambitious programs to add elevators to their existing stock of occupied walk-up apartment buildings – a virtually unknown concept in the United States.

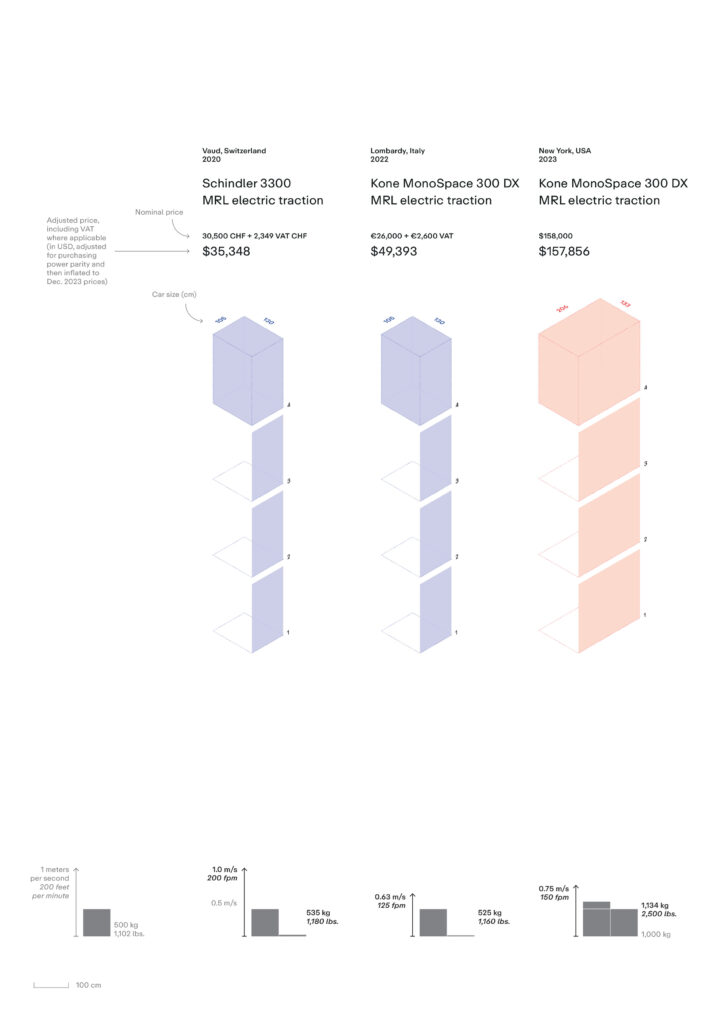

And behind its lack of elevators, North America faces a crippling cost problem. The price to install an elevator in a new mid-rise building in the United States or Canada is now at least three times the cost in Western Europe or East Asia. Ongoing expenses like service contracts, periodic inspections, repairs, and modernizations are just as overpriced. High-income countries with strong labor movements and high safety standards from South Korea to Switzerland have found ways to install wheelchair-accessible elevators in mid-rise apartment buildings for around $50,000 each, even after adjusting for America’s typically higher general price levels. In the United States and Canada, on the other hand, these installations start at around $150,000 in even low-cost areas.

The cost problem tends to lead not to larger portions of individual project budgets allocated to elevators, but to fewer elevators overall. Small apartment buildings which would have elevators in Western Europe are built as walk-up buildings in the United States. Other projects throughout North America are built not as apartments at all, but as townhouses. Larger sites aren’t broken up into smaller segments, each with their own elevator serving a dozen or so apartments, as in Europe, but rather are combined into large, double-loaded corridor buildings, with one elevator for every 50 to 100 units (or more).

This report takes the cost discrepancy as its major research question: why is there such a vast gap in prices, what are the effects, and how might prices for elevators in the United States and Canada be brought down to earth? The experiences of other high-income countries show us the bounds of what is realistic, and offer suggestions for policies to implement in North America that have proven track records abroad.

Three major differences between North America and the rest of the world emerged in our research, which drive up the cost of elevators in North America: the size of elevator cabins, the availability of skilled elevator labor, and the technical codes and standards governing the construction of elevators and the availability of parts.

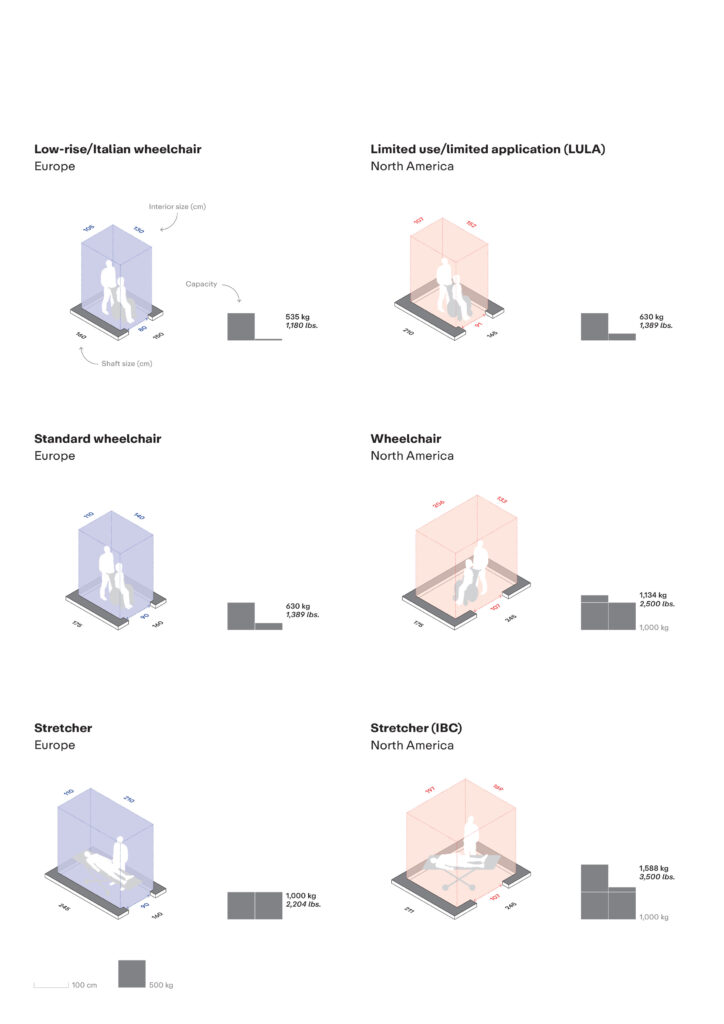

Elevator cars in the United States and Canada are much larger than those in Europe in particular, with the typical new elevator being about twice the size. This difference in size is driven by regulations to accommodate people in wheelchairs and people experiencing medical emergencies who are taken out of buildings on stretchers, although these same groups are also the ones who suffer the most when elevators go unbuilt due to the expense.

Elevator labor is also much harder to come by in the United States and Canada. Immigration laws in North America are unfriendly to non-college-graduate workers. Domestic educational systems are oriented towards training white-collar workers, with weak technical and vocational instruction of the type that is more useful to the elevator industry. The union representing most North American elevator workers takes advantage of and exacerbates this skills shortage to bargain for inefficiencies in new installations and other elevator work, leading manufacturers to forgo some of the preassembly and prefabrication and other efficiencies common in the rest of the world.

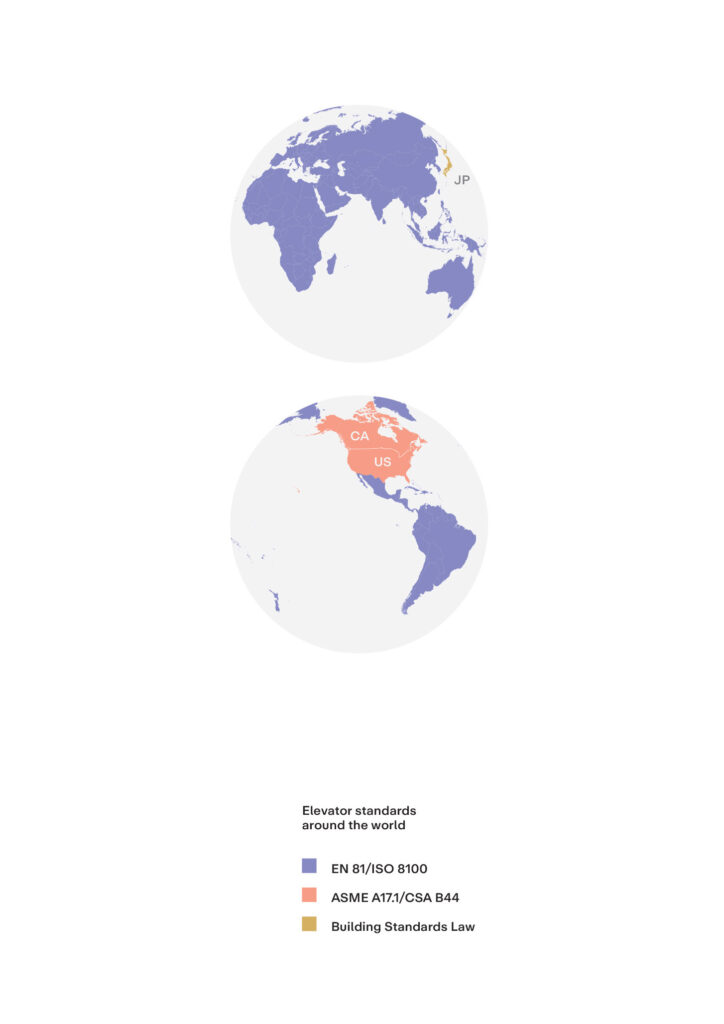

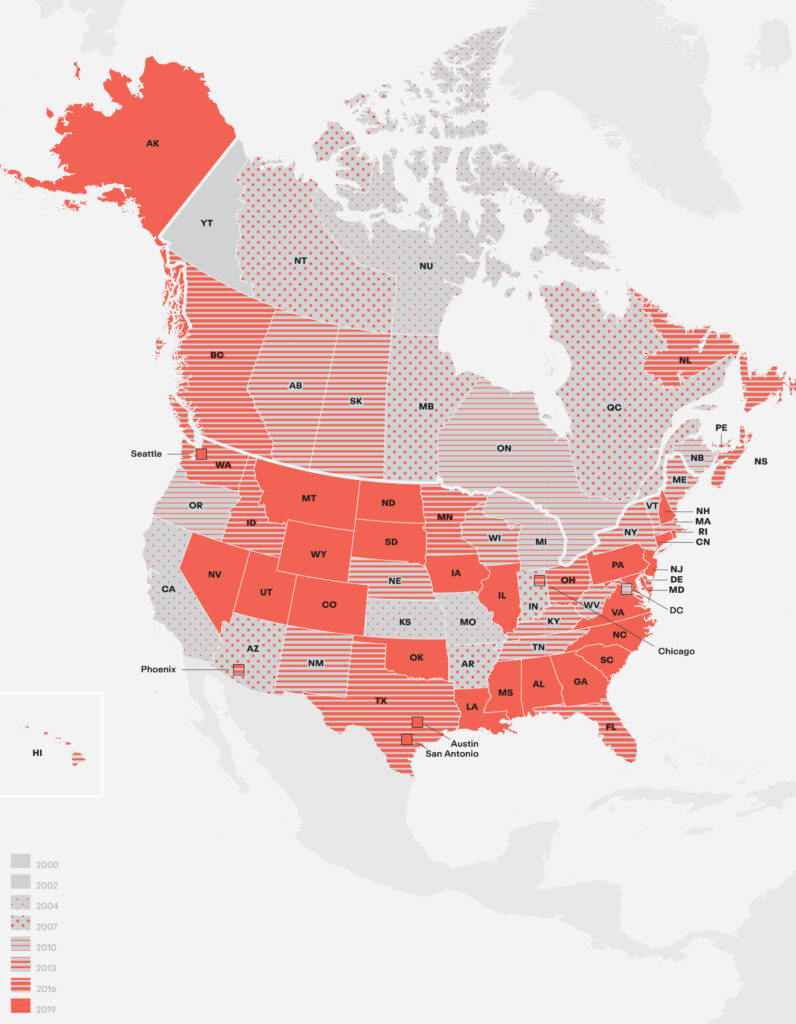

And finally, the United States and Canada have walled themselves off from the global market for parts through a unique web of technical codes and standards for elevators, while virtually the entire rest of the world has pursued harmonization with the dominant European standards.

This report focuses on the policy details of the elevator industry, but broader differences in attitudes and expectations between North America and the rest of the developed world drive these industry-specific policies. Different mindsets around and approaches to accessibility, emergency medical services, fire protection, electrical equipment, architecture, and the logistics of the regulatory state deeply affect the elevator industry in ways that are beyond the industry’s control. It’s a philosophy that works better than anywhere in the world at fulfilling the desires of a diverse set of stakeholders in situations where resources are abundant, but which pays for it by withholding access where resources are more limited.

The North American approach is one of extremes. American and Canadian elevators have the largest cabins, the strongest doors, the most redundant communication systems, the best paid workers, and he most diversity of codes on the one hand. And in exchange, Americans and Canadians have the highest prices, the most limited access, the most uncompetitive market for parts, and the most restricted labor markets.

Elevators are one of the most unique systems in a building, and the most inscrutable to those outside of the industry. They account for only around 2 percent of the total cost of construction, where installed. But the challenges of the industry and its regulatory environment are not unique to vertical transportation. Applying these ideas to other building systems and construction sub-sectors will be left as an exercise to the reader, but we hope the themes covered in this report can offer a lens into North America’s construction challenges more broadly – the difficulty of building multifamily housing, the limited materials market, the ever-tightening labor market, and the challenges of providing accessibility in an aging and more inclusive world.

1.1 Notes on methodology

This report focuses on comparing the elevator industry in the United States and Canada, referred to as “North America” (which, in this report, does not include Mexico or Central America), to the elevator industry in Spain, France, Germany, Italy, and Switzerland in particular, while also drawing on experiences in other countries in Europe, East Asia, and Oceania. The main Western European comparator countries were chosen for their large installed elevator stocks, high incomes, high safety and labor standards, and the language abilities of the author. This report focuses on elevators in apartment buildings (both rentals and condos), since these buildings are home to most elevators, and are where the decision to install an elevator is most variable according to cost.

Most elevator industry revenue and even more of its profit come from expenses incurred after a building is first built, but this report focuses on new installations. This is because new installations are more homogenous and easier to compare across different settings. The issues that contribute to high costs for new elevators – around labor, availability of components, and car sizes – apply in similar ways to repairs, maintenance, inspections, and modernizations, so the new installation issues that this report prioritizes are relevant throughout the elevator’s lifecycle.

Because this report is the first public attempt to study the North American elevator industry through the lens of international comparison, there are many opportunities for future research, which are summarized at the end.

Both metric and United States customary units are used in this report, with conversions given where appropriate. Currencies are typically left as-is, except in pricing tables, where an adjusted total is listed which converts nominal prices into U.S. dollars using the OECD’s purchasing power parity conversion factor (to account for cost-of-living differences), and then inflates them into December 2023 dollars to account for the high rate of inflation that the western world has experienced over the last few years. 3 Different tax policies can complicate price comparisons, but for new installation price comparisons, value-added taxes in Europe are noted separately as nominal costs and included in adjusted prices. For installations in the United States, sales taxes are not generally applied to final prices for elevators as they are classified as exempt capital improvements, though sales taxes may have been already paid on intermediate components and are therefore already factored into prices.Markups applied by contractors are left out of all prices 4.

All sources of data have imprecision, some more so than others – rough estimates of costs for certain components, national elevator stocks estimated to sometimes only a single significant digit by trade organizations or with uncertain inclusion of escalators, cabin sizes that vary according to manufacturer and model. Elevator sales are usually a private affair, and precise data on cost in particular is a trade secret that is difficult to track down. That said, the gaps in prices between North America and the rest of the world are so large that small imprecisions and adjustments do not meaningfully change the conclusions.

Assertions in this report based on publicly available information are cited. Other information is sourced from around 100 off-the-record interviews or informal conversations with elevator industry professionals, wheelchair users, architects, developers, and others, and is not cited to avoid crowding the text with unhelpful anonymous citations.

1.2 Acknowledgements

While this report was authored solely by Stephen Smith, executive director of the Center for Building in North America. Four researchers in particularly contributed to my understanding of the elevator industry abroad – Kuba Snopek and Petro Vladimirov in Poland with the firm Direction, who conducted interviews with individuals in both Poland and much of Western Europe, as well as Geli Tadonki in France and Moon Hoon in South Korea, who contributed information from their respective countries. They are not responsible for any errors or omissions regarding those countries, and did not participate in the writing of the report.

I would like to thank Allison Allgaier, Justina Bacinska, Richard Blaska, Joe Caracappa, José Carlos Frechilla, James Colgate, Bob Danek, Bryn Davidson, Daniel Dunham, Ray Eleid, Jeffrey Evans, Will Evans, Sergio Gianoli, Laurens Gilen, Markus Hansen, Kevin Heling, Mike Jackson, Robert Kasperma, Chip Kouba, Iain MacKenzie, Tabitha Nichols, Kimberly Paarlberg, Evan Petrower, Tadeusz Popielas, Lee Rigby, Michael Schneider, Rory Smith, Jon Soberman, Blair Suzuki, Stephen Thomas, Steven Winkel, and Raïd Zaraket for some of the interviews granted and information provided. None of the above individuals or their respective organizations viewed a copy of this report before publishing, they bear no responsibility for errors or omissions, and they may even disagree with this report’s findings and recommendations. Nevertheless, I would like to thank them for their time, as it would not have been possible to write this without them.

2 Access

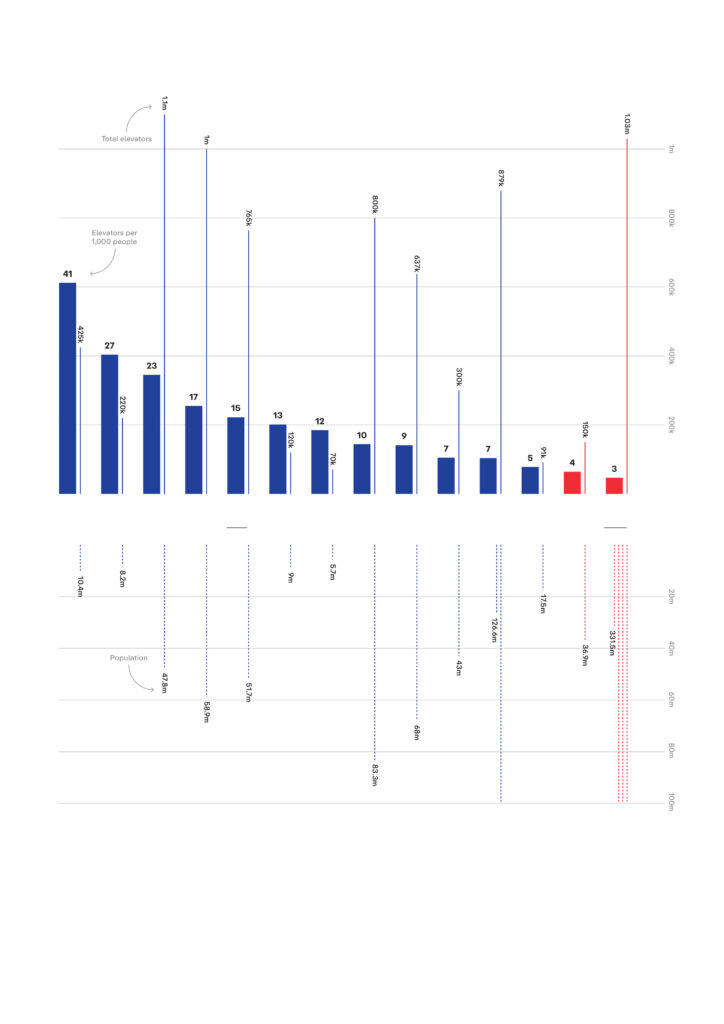

The United States and Canada have fewer elevators per capita than any other high-income country for data could be found. This shortage of elevators in North America drives what types of buildings are constructed at all, and what types of buildings, when built, are equipped with elevators. While accessibility rules mandate elevators in certain situations, the reality is that regulations respond to market conditions as much as they shape them. And in the United States, regulations mandating elevator access for multifamily buildings can be much looser than in other high-income countries (which, despite generally being classified as “high-income”, are almost always less wealthy than the United States).

At last count, the United States had over 1.03 million elevators.5 America is tied with Italy and Spain for second place in total installed units, behind China’s fleet of over 8 million elevators.6 While 1.03 million installed units is in absolute terms among the highest in the world, America has fallen far behind when the number of elevators is adjusted for population. The U.S. has very few elevators on a per-capita basis for a highly developed nation, even accounting for its suburban character (the number of elevators in Canada is not known, but one rough estimate suggests it is similar to the United States on a per capita basis, and recent provincial figures back that up).7 A major reason for the relatively few elevators in the U.S. and Canada is the cost of installation: American and Canadian developers pay roughly three times as much to install an elevator as developers in high-income peer countries in Europe and Asia.

High elevator costs conspire with other forces to push North American developers to build townhouses rather than the small condominium buildings more common abroad. Where small apartment buildings are built in North America, they are more likely to be walk-ups than similar buildings in Western Europe. North American apartment buildings have more units per elevator core than their similarly tall counterparts in Western Europe, in part to spread the high cost of elevators across more apartments. And unlike in Europe and Asia, elevators are almost never added to existing walk-up buildings in North America, depriving aging populations of improvements in access in apartments that have already been built.

2.1 Stock

Exact data on the number of elevator installations is hard to come by, but according to the data we were able to assemble, there is no high-income country on earth with fewer elevators per capita than the United States. The United States’s total elevator stock, in absolute terms, roughly matches those of Spain or Italy, individually, despite having seven and five times the population, respectively.

1 This estimate is conservative, and there may be up to 600,000 elevators in the country.

2 No nationwide figure was available for Canada, so data from Ontario, British Columbia, and Saskatchewan was extrapolated to arrive at a nationwide estimate.

America’s vast geographic expanse and love of single-family houses explain some of the country’s lack of elevators, but not all of it. Single-family houses aside, the United States has over 32 million apartments, while Spain has fewer than 13 million apartments but about the same number of elevators.8 The U.S. has 40 percent fewer elevators per capita than the Netherlands, despite 30 percent of the American housing stock being in multifamily dwellings (and 19 percent in buildings with at least 10 units), compared to a total multifamily housing share of just 21 percent in the Netherlands.9 New York City has roughly the same population as Switzerland and even more New Yorkers live in apartment buildings than Swiss residents do, but New York only has half the number of passenger elevators.10 No matter how you slice the numbers, America has fallen behind on elevators.

2.1.1 Walk-ups and elevator buildings

With far higher costs and fewer elevators per capita, elevators are provided in new apartment buildings in Western Europe at building heights and unit counts which are deemed too low to justify the cost in the United States. Federal accessibility law and locally adopted building codes in the U.S. are far more permissive of walk-up apartment buildings than regulations in Western Europe, likely as a consequence of high elevator costs. Developers in the U.S. build new walk-up rental apartments and condos to sizes, heights, and rents that shock Western Europeans, and developers in the U.S. seek out loopholes and vagueness in codes to avoid building elevators in circumstances where not only building regulators, but also the market, would demand accessibility in Europe. In high-cost coastal American cities, elevator access for new luxury apartments can fall behind access found in middle-class housing in Southern Europe built more than half a century ago.

Europe

The early history of elevators in Europe largely mirrors that of North America, with elevators first coming to the continent in the 19th century, but largely limited to commercial and institutional buildings. Elevators began to be used in residential buildings in Europe in the early 20th century and particularly after World War I, but due to their cost relative to local incomes, they were relegated largely to luxury buildings. Early hints of Italy’s modern elevator abundance can be seen in six- and seven-story buildings from the 1930s, with a dozen or fewer apartments and two elevators – one for residents and the other for domestic staff.11

After World War II, Europe’s elevator industry took off in a much bigger way. Southern European countries emerged as the largest markets, with rapid post-war urbanization and densification in Italy, Spain, and Greece bringing small elevators to middle-class condominium buildings (though not yet, for the most part, social housing).12 Northern Europe was less aggressive with elevator building, perhaps due to the preference among elites and middle class for single-family houses, and walk-up buildings of three stories remained common for longer than in Southern Europe.

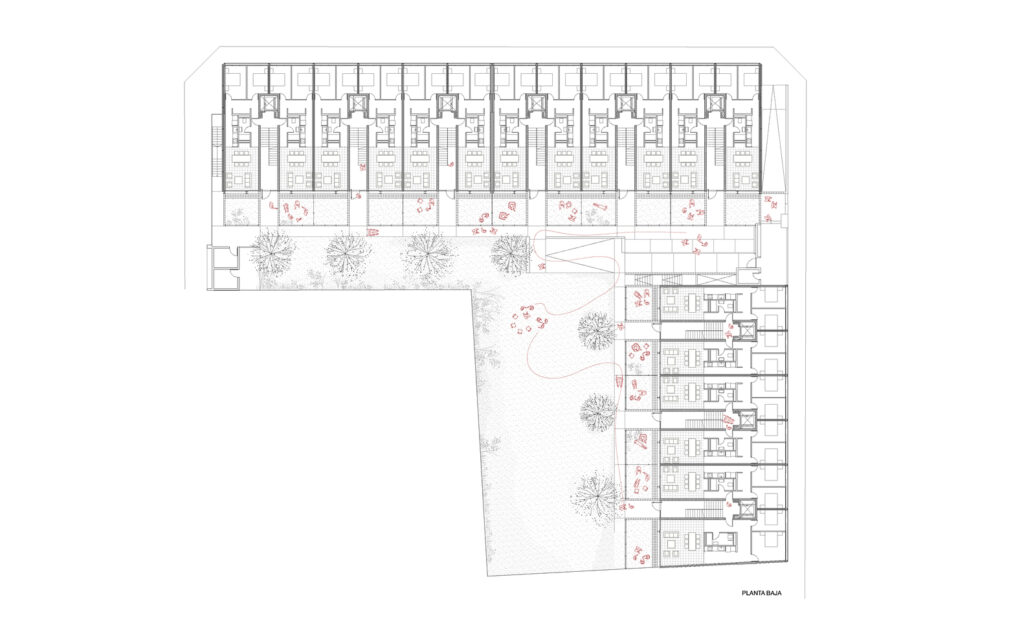

Today, Northern Europe has caught up to Southern Europe in access to elevators in new buildings, and elevators are an expected feature of virtually all new multifamily buildings – whether rentals or condos, social or private housing, and almost any size – across Western Europe. On the Spanish island of Mallorca, a recently built 54-unit social housing project includes a total of nine elevators – one for each stairwell, with four stops (at the underground parking, the ground floor, and the two upper floors) serving six units each, with only four of the apartments above the ground floor.13 In Switzerland, elevators are so ubiquitous in new buildings that proper commercial elevators can be found even in some luxury two-family houses.14

Accessibility laws and codes in Western Europe have varying requirements for the installation of elevators in multifamily buildings, but for the most part, market supply and demand provides elevators even for buildings that don’t reach these required thresholds.

France recently strengthened its accessibility rules, and now requires elevators for apartment buildings of at least four stories, compared to the previous five-story threshold. But about 80 percent of new four-story apartment buildings built in France around a decade before the law was updated already had elevators, rising to almost 100 percent for private housing, and the stricter rules were mainly aimed at ensuring that four-story social housing projects are equipped with elevators.15

In Germany, the national model building code requires elevators in apartment buildings where the floor of the uppermost level is at least 13 meters above grade in a section more or less adopted in all states, and at least one floor must be accessible in any building with more than two apartments (effectively requiring an elevator for buildings where the ground floor is parking or non-residential).16 But while five-story apartment buildings can legally be built without elevators, in practice even most small three-story buildings are provided with them, as the expense is low enough that it is justified by the additional rent or higher purchase price that more accessible units can command.

Elevator requirements for new multifamily buildings vary in other countries in Europe. Italy and Spain, with the largest installed elevator fleets in Europe, also have some of the strictest accessibility requirements. They require an elevator (or room to add one at a later point) in all multistory apartment buildings, as does Sweden.17 In some countries – for example in Norway or Denmark, where an elevator is required starting at three stories – a developer will sometimes try to dodge the requirement by having bilevel apartments on the top two floors, making the second level the tallest level of entry.18 In Switzerland, the law varies by canton, but the Canton of Geneva requires an elevator for any building with at least three levels (including any underground levels, which nearly all new apartment buildings have for parking and storage), while the Canton of Zurich requires ground floor accessibility starting at five units and full-building access by elevator or ramp above eight units.19 Given market preference though, it is rare to find a new multi-unit building of any size in Switzerland without an elevator.

United States

The United States was the birthplace of the modern elevator in the 1850s, and for the first half of the device’s life, American cities likely had the most elevators. The elevator was a key enabler of the commercial skyscraper, a building typology born in the United States that would come to define its cities. High-rise American downtowns stood in contrast to European city centers, which were mostly capped at mid-rise heights. The elevator began to be used at scale in American apartment buildings in the early 20th century, starting in upper-class buildings and working its way down the income scale as the century progressed.

New York City had a high concentration of elevators, with Manhattan already having 10,000 passenger installations by 1914, a quarter of which were in residential buildings.20 Russian revolutionary Leon Trotsky chose an apartment in a Bronx “workers’ district” to rent for a three-month stint in New York City in 1917 after being run out of Europe, where an “automatic service-elevator” (likely some type of dumbwaiter) was among his list of “all sorts of conveniences that we Europeans were quite unused to.”21 Elevators figured prominently in New York City’s uptown and outer borough apartment booms in the years between the two world wars and in the two decades after the end of World War II, in buildings typically of five or more stories in neighborhoods opened up to development by the new subway system.

America’s elevator-fueled urban building boom would come to an end as the country turned away from its cities and towards suburban growth as the post-war decades wore on. New York City adopted a new zoning code in 1961 that severely curtailed infill development tall enough to make use of an elevator, and cities and suburbs across the nation passed similar restrictions around the same time and in the decades following. Multifamily development continued, but in more suburban areas, and at lower heights. One of the most popular building types was the garden apartment. This two- and later three-story multifamily style featured a few apartments per landing off of a series of separate, often exterior stairways, chained together in a row (sometimes winding around a courtyard) to form a larger building. Like the similar building typology in Germany and other Northern European countries, these were walk-up buildings, as were the smaller two-story infill versions popular in West Coast cities like Los Angeles and Oakland. Elevatored apartments were still being built in smaller numbers in dense cities like New York and Chicago, but the elevator industry turned more to commercial buildings like offices and hotels, and special residential uses like senior living, as the nation’s homebuilders turned to the suburbs.

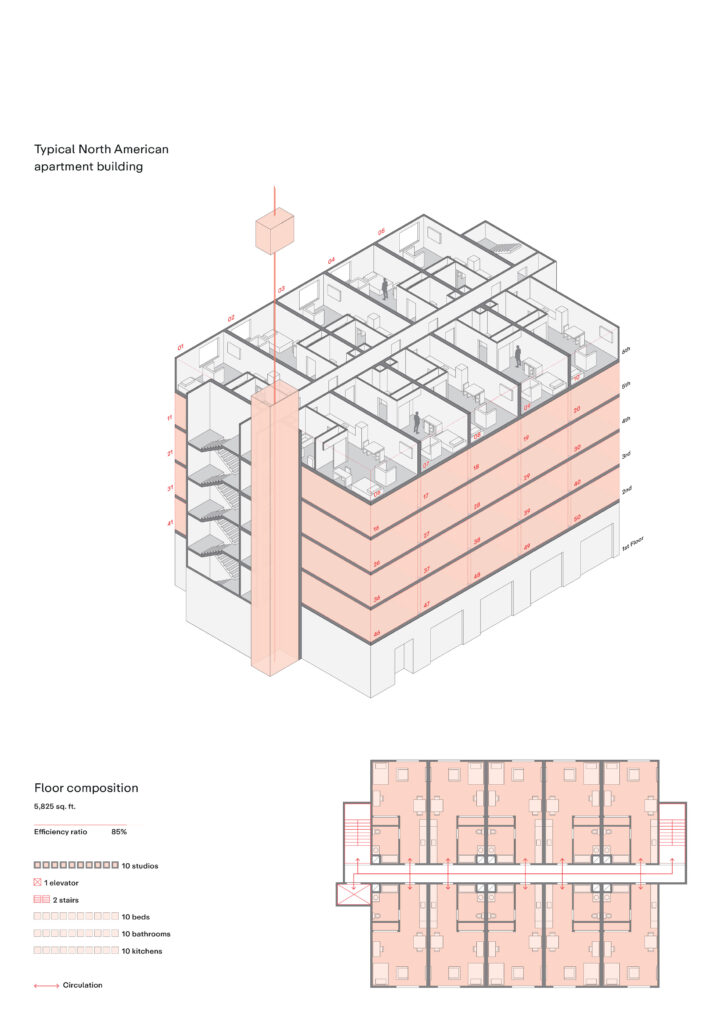

Today, demand – and in many cases zoning – for elevatored multifamily buildings has returned. In 2016, the industry was back to installing around 40,000 elevators each year in the United States and Canada.22 Elevators continue to be installed in high-rise condo and rental apartment towers, but are also now found in large mid-rise apartment buildings with dozens or even hundreds of apartments. Units in these four- to six-story buildings, sometimes called “5-over-1s,” are arrayed along either side of long, straight, hotel-like “double-loaded corridors” in urban and suburban locations across the U.S.

But while many elevatored apartment buildings are now being built across the United States, many walk-up complexes are also still being built, at a scale and to heights that are unique in the developed world.

Three-story garden apartment complexes, with four apartments per floor around each staircase, are still a popular typology in suburban and exurban areas in the American Sunbelt. On the fringes of Austin or the exurbs of Charlotte or Tampa, for example, these buildings continue to be built as walk-ups, much as they were over half a century ago. These types of buildings largely have elevators in Europe even when not legally required, but six to 12 units in each core (four to eight of which would be above the ground floor) are not enough to justify the high cost of elevators in America. And in some cases even much larger buildings are, in developers’ estimation, not worth the cost of an elevator. One newly built market-rate apartment complex on the outskirts of Austin has two three-story buildings with 60 units each, and no elevator.23 Another in a downtown-adjacent neighborhood in Dallas has a three-story walk-up with 86 units and no elevator (the developer said that the concern was less the cost of installation than the high operating costs, since the local market could not support the rents of luxury buildings).

Within the denser cores of American cities, developers sometimes build even taller walk-ups. Particularly in New York City, Seattle, and Hawaii, building codes allow up to six stories (rather than the usual three in the U.S.) to be served by a single staircase, enabling the development of buildings on small lots with only a few units per floor. With fewer apartments in each building, the per-unit cost of an elevator rises, and it becomes tempting for developers to test the rental market’s tolerance for walk-ups, pushing them to four, five, and even six stories. Unlike two- and three-story garden apartments farther from city centers, these types of buildings can, especially on the mainland, have quite high rents. In the author’s own condo building in Brooklyn, a fifth-floor one-bedroom, one-bathroom apartment built in a mid-2010s walk-up recently rented for $3,800 per month.

New York City’s high-quality property and elevator data allow for a quantitative analysis of developers’ propensity to build elevators. It shows that four-story buildings (which are the tallest that can be built without an elevator according to the city’s building code, at least without some occasionally exploited loopholes) almost never have elevators. The analysis found that the likelihood of a new four-story multifamily building having an elevator in New York City does not exceed 50 percent until the building reaches a total gross floor area of 24,000 square feet.24

New five-story walk-ups are also in various stages of development in Los Angeles and Honolulu. Both cities have programs that offer zoning relief for buildings with rents that do not exceed a certain level, but without any particular design standards that require elevators even where ordinary codes and laws do not. A zoning relief bill in Honolulu was written with taller walk-ups in mind, with the text specifying that no elevator is required to take advantage of the program, and developers have built apartments up to five stories tall using the law.25 In Los Angeles, developers have filed plans to build five-story walk-ups with as many as 72 small studio units using the city’s ED1 program.26

And in Seattle, developers have gone even taller in recent years, developing a number of new six-story buildings, mostly market-rate, without elevators without any difficulty leasing the units, according to somebody involved in the development of one. Not only does omitting an elevator save developers money on construction and operations, but it also allows developers to squeeze more leasable space from both the unbuilt elevator shaft and from space saved in apartment bathrooms that are not wheelchair-accessible since they can’t be reached in one anyway (see “Areas for further research”).

Tall walk-ups are allowed under the model building code used in the United States, which does not require an elevator for apartment buildings of any height, deferring to federal law on the matter. Federal law, since the passage of the Fair Housing Amendments Act of 1988, only requires an elevator for new multifamily buildings if the ground floor contains no apartments (if it is reserved for parking or retail, for example), and even in that case, the elevator only has to reach the first level with apartments, not all of the floors above.27

The International Building Code, the model building code adopted in almost every U.S. jurisdiction (and in no other major country), has a section titled “Elevators required,” numbered as Section 1009.2.1, which, confusingly, does not in fact require elevators:

In buildings where a required accessible floor or occupied roof is four or more stories above or below a level of exit discharge, not less than one required accessible means of egress shall be an elevator complying with Section 1009.4.28

The section is confusing in two ways. For one, “four or more stories above…a level of exit discharge” means what an ordinary American would call the fifth story, as the level of exit discharge is typically the ground floor, the first story above it is the second floor, and so on. More consequentially, the section starts out by referring to “a required accessible floor” without defining it – the term is unitalicized in the text, meaning there is no definition in Section 202, “Definitions.” According to those involved in drafting the model code, “a required accessible floor” is a reference to federal law. As long as federal law allows only the ground floor of a multifamily building to be accessible, adopted building codes generally impose no further requirements. As far as this author is aware, only New York City modifies the text to require elevators in buildings of at least five stories.29

And while New York City is not as permissive as the rest of the country, developers in New York still seek out loopholes to avoid the high cost of elevators for relatively small buildings. One common way to push the four-story walk-up limit is to restrict the fifth floor to at most one-third of the area of the lower floors and make it accessible only through a private staircase from within a dwelling unit that starts on the fourth story, a trick commonly executed in new buildings. Buildings of this “4⅓- story” type range from relatively low-cost rentals to full-floor condos selling for more than $2 million. Another path to taller walk-up buildings is to extend an older building upwards, grandfathering it into an older building code (as in the author’s own building). There is a strong market for tall walk-up buildings across the city at a range of different price points, with tenants, condo buyers, and developers alike comfortable buying, selling, and renting units on and above the fourth floor without elevators, where allowed.30

Going forward, recent trends in urban planning call into question North America’s commitment to elevators and accessibility in new apartment buildings. Pro-housing advocates, identifying with the slogan “yes in my backyard” (or YIMBY – a play on “not in my backyard,” or NIMBY), are beginning to win changes to zoning and other planning laws that restrict development on most urbanized land in North America to single-family houses. Zoning for “missing middle” housing – a term for housing typologies denser than a detached single-family house but less costly than large mid- and high-rise apartments, which have gone “missing” in modern planning – involves making room for small two- through four-story buildings. These buildings are not tall enough to require or justify elevators in the U.S., a fact which does not go unnoticed by proponents. In one report, builders described the most viable type of missing middle multifamily housing to researchers at the Terner Center for Housing Innovation at the University of California, Berkeley as having eight to 12 units, “without elevators.”31

Minneapolis made headlines in 2018 by abolishing single-family zoning across the entire city, but most land is only zoned for three units up to three stories, which is not tall enough to justify an elevator given North American costs.32 An update to Sacramento’s general plan will allow more units on each single-family lot, hoping to stimulate more infill than Minneapolis has, but still limited to around three stories, also shy of the height where an American developer could afford to install an elevator.33 In Canada, Toronto’s city council recently voted to allow up to four units on land previously zoned for single-family houses, and Vancouver’s upcoming “multiplex proposal” will allow buildings of up to six units and three stories, all of which will largely be walk-ups.34 And townhouses – defined as small-lot, often attached single-family houses of two to four stories – are an increasingly popular dense infill building type in cities like Houston, Denver, Philadelphia, and Calgary, which sidestep even ground floor accessibility requirements and offer no elevators (except, occasionally, slow models allowed to be built to lesser standards in very high-end homes).35

Urbanist ambivalence towards elevators and idolization of walk-ups has a long history in North America, dating back to ur-urbanist Jane Jacobs. In The Death and Life of Great American Cities, the New York City- and later Toronto-based writer repeatedly portrayed elevator buildings as anti-urban and sterile, with the cabs being filthy and dangerous. While she took pains to clarify that she wasn’t against all buildings with elevators, she wrote that “[e]levator apartments” can be “probably the most dangerous way of doing [density].” Later in the book she devoted a page to the problem of elevators in high-rise public housing projects, listing all of the evils that can occur in them: “children urinat[ing],” “extortion and sexual molestation of younger children by older children” by day, and “adult attacks, muggings, and robberies” by night. She proposed full-time elevator attendants as the “only solution that I can see to this problem,” validated by what she’d heard of some buildings in Caracas, Venezuela, where female tenants operated elevators by day and were replaced by men at night.36 Writing in 1962, Boston-based planner and sociologist Herbert Gans echoed Jacobs’s criticisms, writing in a review of her book that “the interior streets and elevators” of public housing projects “invite rape, theft, and vandalism. Areas like this are blighted by dullness from the start, and are destined to become slums before their time.”37

The distaste from Jane Jacobs and her mid-century urbanist peers for elevator buildings would eventually leap off the page and into real world planning in New York. In 1959, Jacobs led a group of local activists who tried to convince the New York City Housing Authority to scrap their plans for high-rises at the future site of the DeWitt Clinton Houses in East Harlem, and instead opt for an alternative design of four- and five-story walk-ups. The public housing authority ignored the group’s proposal and instead built something close to the original plan, but the anti-elevator contingent would eventually prevail upon the city at the planned West Village Houses in Jacobs’s own West Village neighborhood. Along half a dozen blocks of Washington Street, a block inland from the deindustrialized Hudson River waterfront, Jacobs and activists in her orbit agitated against high-rise towers, or even mid-rises tall enough for elevators. “The dangers of unattended elevators to children – and adults,” read a brochure, “are already too well known to require retelling here,” and anyway, in the Village, they wrote, “walking upstairs is considered a sound and healthy diversion.”38

In 1969, the group won their fight. Blocks of five-story walk-ups were approved for the sites, and the city’s Housing and Development Administrator told the New York Times that “[o]pposition to the plan had centered around” the lack of elevators, but “[i]n my opinion, the design is the plan’s greatest strength. It conforms to our commitment that new housing must not destroy a community,” as elevator buildings presumably would, “but should, instead, strengthen it.” Like 19th century brownstones, the austere red brick buildings were designed with steps leading to even the ground floor apartments to offer privacy from the street, so none of the units are accessible to this day.39 The lack of elevators would make the West Village Houses ineligible for a federal mortgage, so the city had to redirect funding from lower-income neighborhoods to subsidize it, with financial assistance to the project continuing for generations.40

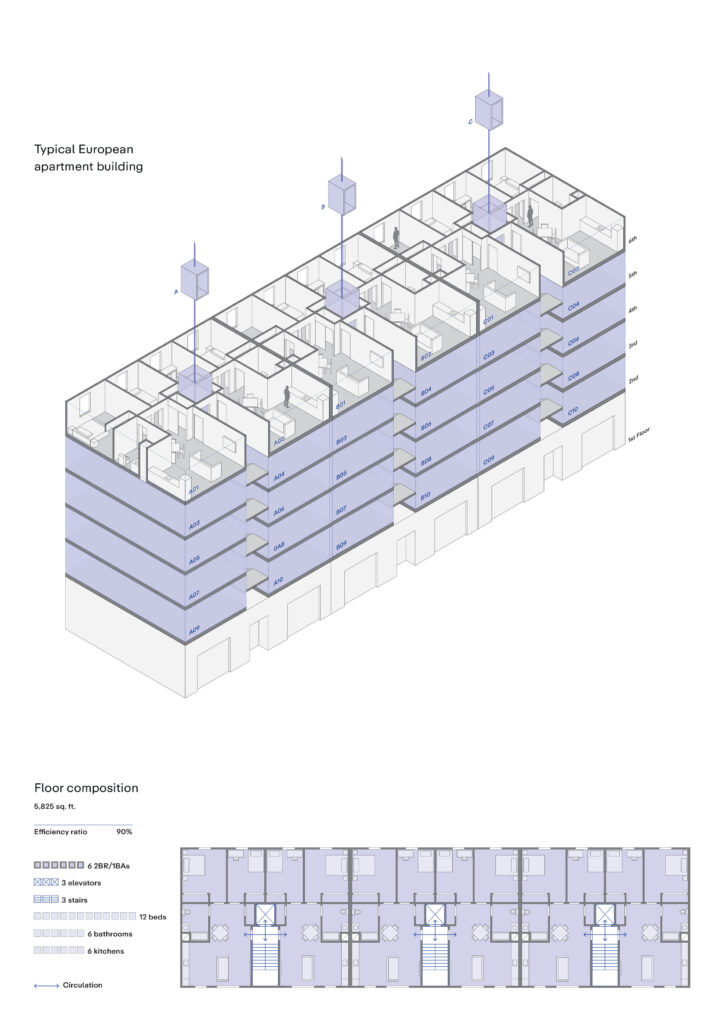

Jane Jacobs’s and Herbert Gans’s dislike of elevator buildings was tied to what Jacobs called “the related corridor problem.” By this she meant the North American habit, which grew stronger in the latter half of the 20th century, of arraying apartments off of long corridors. This stands in contrast to the more common pattern in the rest of the world of a few apartments organized around the landing of a single staircase. American and Canadian building codes don’t usually allow these so-called “point access blocks,” as they require two stairways in even small buildings. North American codes result in long corridors, as architects and developers pile as many apartments as possible onto each floor to avoid expensive duplication of these two required staircases. This tendency to load a single corridor with many apartments also makes North America’s very expensive elevators more affordable on a per-unit basis.

Americans and Canadians are rethinking these code requirements, and smaller single-stair point access blocks are coming back in style among planners and architects, and perhaps soon, in building codes themselves.41 If these new buildings are equipped with elevators, they would solve many of the problems of anonymous, hotel-like corridors that Jacobs and Gans associated with elevator buildings. But if left unchecked, the high cost of North American elevators would become even more of a problem as the number of apartments in a building falls, discouraging construction beyond certain heights and causing developers to forgo elevators where they are optional.

2.1.2 Elevator retrofits in existing buildings

People in the developed world are rapidly aging, and housing stock growth is slowing down as population growth is too. It’s a common saying in architecture that 80 percent of buildings that will exist by 2050 have already been built, driving home the need to retrofit existing buildings for sustainability in addition to perfecting techniques for new construction.42 The same logic applies to accessibility and elevators – if most of the homes that we’ll grow old with have already been built, then it is necessary to find ways to bring elevators to buildings that don’t currently have them. And so across Europe and Asia, governments are using subsidies and other policies to support the construction of elevators in older walk-up apartment buildings. Critical to those efforts, though, is the affordability of the installations, as subsidy and private funds for retrofit projects are limited.

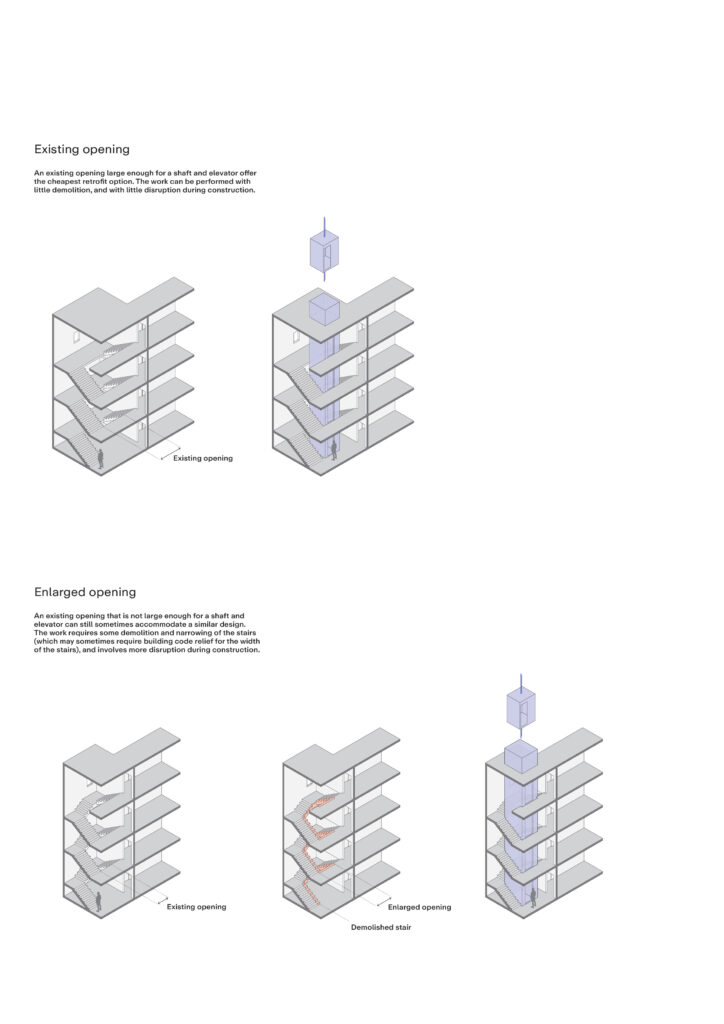

Adding elevators to older buildings is more expensive and logistically challenging than installing them in new ones, especially if the building is occupied and access must be maintained throughout the construction project. One of the biggest challenges is the issue of placement. Ideally, the staircase has enough room inside of it to build the shaft, making it possible to offer step-free access to upper floor apartments without leaving the footprint of the building, altering the staircase, or taking living space away from apartments. If that room is not available, then the shaft can be built outside of the building and attached with a balcony, or space can be carved out of dwelling units.

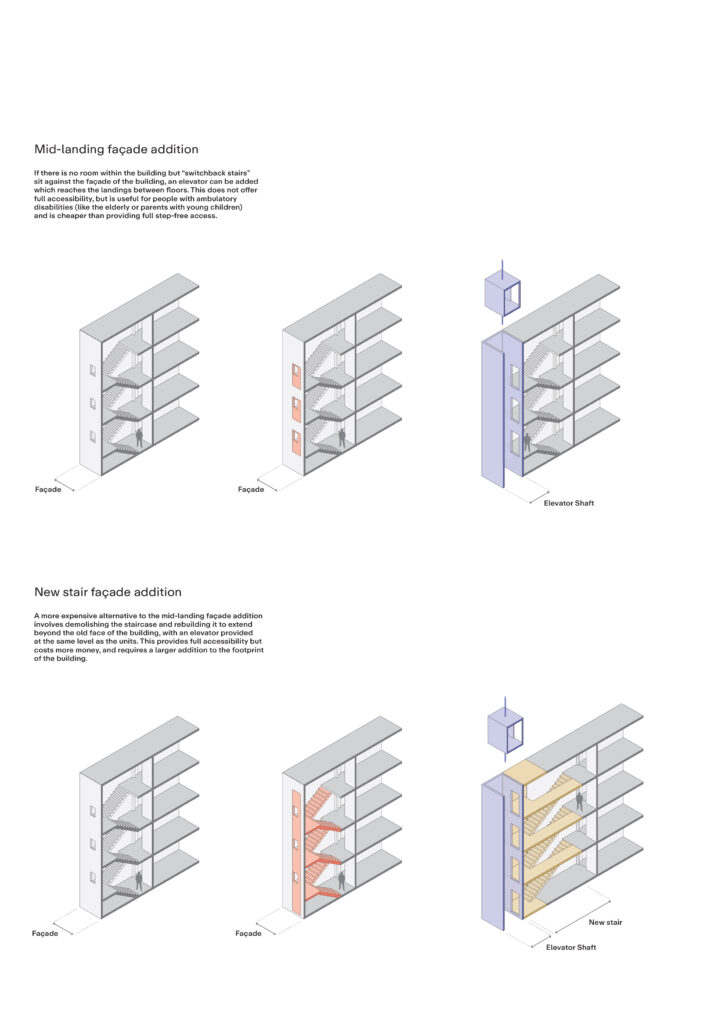

U-shaped, or switchback, staircases with landings halfway between stories present special design challenges, since the easiest place to put the elevator is on the outside of the building, where residents would still have to climb half a flight of stairs to get from the elevator to their apartment. Sometimes this is simply accepted as a compromise – wheelchair users won’t be able to move independently, but the elderly and ambulatory disabled who can manage a few stairs, parents with young children, or movers or anybody else carrying large items can at least avoid most of the steps in the building. But for more ambitious property owners who want full accessibility, the staircase can be demolished and rebuilt to extend beyond the old façade of the building, replacing switchback stairs with a straight flight of stairs heading down and beyond the old façade to an elevator at the end, and then a narrow corridor heading back to the apartments.43

Europe and China

Costs in Europe can start around the low tens of thousands of euros for installations that can sit inside of a stairwell – not much more than an elevator installed in an already built shaft in a new building – and rise to over €100,000 for an elevator that has to be attached to the façade or break through existing floors.44 In Chinese retrofits, elevators typically attach to the façade, and cost less than $100,000.45 Since older apartment buildings in Europe and Asia are typically designed with only a few units per floor off of a single staircase and apartments are usually individually owned, as few as a handful and up to a few dozen different owners have to come together to agree to move forward with a project – enough owners to create a coordination hassle, but few enough that the cost of the project has to be carefully controlled lest the installation become unaffordable.

As with all things elevators, China has the largest market for retrofits. A whopping 51,000 elevators were retrofitted into older buildings in China in 2021 – about as many elevators as were sold in total in North America. Elevators were not common in new Chinese apartment buildings until the late 1990s, so some walk-ups are taller than the five or six stories that was normally the limit in the West, with one 24-story walk-up sitting on a steep slope in Chongqing attracting particular attention (though, to be fair, it has entrances on multiple levels).46 China’s retrofit installations are part of a broader goal, with high-level government backing, to retrofit up to 3 million older walk-up apartment buildings for the country’s rapidly aging population, with one source claiming that over 70 percent of “old buildings inhabited by the urban elderly do not have elevators installed.” Apartment owners pay into projects in proportion to their benefit, with those on upper floors paying more than those on lower floors. Owners near the ground who won’t benefit at all sometimes are sometimes compensated for the noise and loss of light.47 Local governments offer subsidies in the tens of thousands of dollars per new elevator, and contracts to display advertisements in cabins can even cover ongoing maintenance.48

In the West, Spain is one of the leaders in infill elevators. Adding elevators to occupied apartment buildings is so common that Spain has developed a consistent legal framework to make the process easier for owners, and in rarer cases even require that the work move forward against the wishes of a building’s majority. The most common path to a retrofit is a law that allows the majority of owners within an apartment building to vote to undertake accessibility projects, such as the installation of an elevator, with mandatory contributions from everybody who owns a unit in the building. But even without majority consent, a single owner who is disabled or over the age of 70 can compel the rest of the building to contribute to such a project, as long as the additional annual cost of the work – after subsidies by the government, or even residents themselves – does not exceed that of 12 months of ordinary condominium fees.49 And to facilitate the work even beyond government subsidy programs, public sidewalk space must be made available by local governments to accommodate the elevator if needed.50

Beyond Spain, retrofit projects can be found all across Europe. In the 1980s, the Swedish government began a program of working with municipal housing corporations to install prefabricated elevators into post-war walk-up apartment buildings.51 Germany has offered both grants and loans for projects, while the Croatian Lift Association claims that two-thirds of all buildings in Croatia with at least four stories have expressed interest in installing elevators.52 In Italy, the government will rebate 75 percent of the costs to install an elevator and do other accessibility work in condominium buildings, up to €30,000 or €40,000 per unit, depending on the building’s size.53

North America

In North America, elevator retrofits to occupied walk-up apartment buildings are much rarer. Americans and Canadians are just as concerned with accessibility as Europeans, but the cost of projects tends to be prohibitive. Installations in existing buildings are concentrated in loft conversions, or residential renovations of obsolete industrial or commercial buildings. Wealthy homeowners will sometimes install so-called limited use/limited application (LULA) elevators within their own existing single-family homes, but these are much slower than elevators used for multifamily or commercial projects, and typically only move residents between floors within a single dwelling unit.

In New York City, there were a flurry of private tenement house rehabilitations starting around the 1930s that added elevators, with the intention of making worn-out housing more desirable.54 The renovations were rare, though, and involved clearing the buildings and often substantially reconfiguring the floor plans. Towards the end of the 20th century, there was a trend of non-profit housing operators combining vacant Old Law tenements and driving double-loaded corridors through the middle of the buildings, with an elevator located off the new corridor (sometimes in an old air shaft). Each tenement would start out with around 10 or 12 larger apartments, so combining multiple buildings would provide the economies of scale to justify costly elevator installations, especially since non-profit landlords had access to government subsidy.55 More European- or Chinese-style exterior elevator retrofits to at least partly-occupied market-rate buildings did happen in New York, but were much rarer, and have never been offered government subsidy.56

Outside of New York, elevator retrofits in the rest of the United States are no more common. Chicago’s tradition of back porches in small walk-up buildings could easily accommodate infill elevators, as could deck-access buildings (resembling motels, with an outside corridor connecting units next to each other) in mid-century buildings across cities in the American Sun Belt. Honolulu has many three-story deck-access buildings, where a dozen or more upper-floor units could be served by a single elevator. But with rare exceptions, the high cost of elevators in the United States precludes accessibility retrofits of even ideal building types. While subsidy programs would help, the five-figure sums offered by governments in Europe and China would not go very far in the much more expensive American elevator market.

2.1.3 Multifamily elevator ratios

User interviews show that some of the main concerns about elevators by North American wheelchair users who live in apartment buildings are redundancy and reliability. Multiple wheelchair users said they would not consider renting or buying an apartment that did not have access to at least two elevators, and many interviewed had experiences being trapped in (or out of) their apartment due to the lack of a working elevator. Single-elevator buildings (or segments of buildings) are common throughout the world, but fewer elevators are typically provided per apartment in North America than in Europe, due to the size and cost of the installations, as well as the relative lack of small elevator buildings in North America. Very few countries have legal requirements to install more than one elevator, with the market typically left to determine redundancy and elevator ratios.

Where an elevator is included in a project, the number of cabs is determined in different ways in North America and Europe. Due to much lower prices and smaller sizes in Europe, each elevator typically serves far fewer apartments than in North America. However, due to differences in building design and much larger apartment buildings in North America (only tangentially driven by elevator costs), multifamily residents there appear more likely to have access to more than one elevator. Mid-rise point access blocks of just a few apartments per floor served by each stairway and elevator are more common in Europe, with mid- and high-rise double-loaded corridor buildings with a single bank of elevators serving many more units more common in North America.

In the U.S., the typical rule of thumb is that one elevator should be provided for every 50 to 100 apartments, with a second elevator usually provided if a building reaches around eight stories for redundancy and reasonable wait times, regardless of unit count (buildings this tall often but not always have more than 100 units, though New York City is sometimes an exception, with its small lots and more efficient vertical circulation requirements). In Canadian high-rises, it is common to have even more units served by a single elevator. One analysis conducted by a Toronto real estate professional of over 100 condo towers under development or recently completed in that city showed that the median ratio for buildings completed or with finalized designs is one elevator serving every 112 apartments, with some projects having 150 units or more units to each elevator.

In Europe, on the other hand, it is less common for buildings to be large enough that residents have access to more than one elevator. When buildings have multiple elevators, it is usually because they are broken up into multiple point access block segments, with each elevator serving a separate section. When buildings or segments thereof are large enough for two elevators, it’s often because of height rather than unit count. As such, buildings in Europe with multiple elevators tend to have much lower ratios of units to elevators, with perhaps 30 units to each elevator rather than the 100 often found in North America.

This lower ratio of units to elevators in Europe likely has ramifications for reliability and availability, since mechanics say that breakdowns are correlated with use rather than time, although data is proprietary and unavailable (see “Areas for further research”).

One consistency observed over a number of mid-rise multifamily projects in both the United States and Europe is that elevator costs, in buildings that have them, tend to equal roughly 2 percent of total construction costs, irrespective of the price of individual installations. In other words, developers respond to price by adding or removing elevators from their projects. Smaller developments in Europe have elevators where similarly sized ones in North America do not, while larger buildings in Europe have more elevators per apartment compared to those in North America.

2.2 Cost

Elevators in the United States and Canada are dramatically more expensive than those in the rest of the developed world. There are many ways to measure cost, but on the most basic level, new elevator installations – defined as the parts and labor to install a device in a new building, including the rails, support structure, machine, elevator cabin, car and landing doors, controller, and all other ancillary systems, but not the structure of the hoistway that it sits inside – are at least three times as expensive in the United States and Canada as in Western Europe.

Beyond new installations, there are other associated costs that are much higher in the United States and Canada than abroad. Elevator hoistways (also known as shafts) are more expensive to build, and their larger size in North America crowds out other productive uses of building space. Costs incurred after initial installation – money spent on service, maintenance, repairs, monitoring, and modernizations – are also much higher in North America than in Europe, with building owners paying a premium similar to that of new installations.

2.2.1 New installation costs

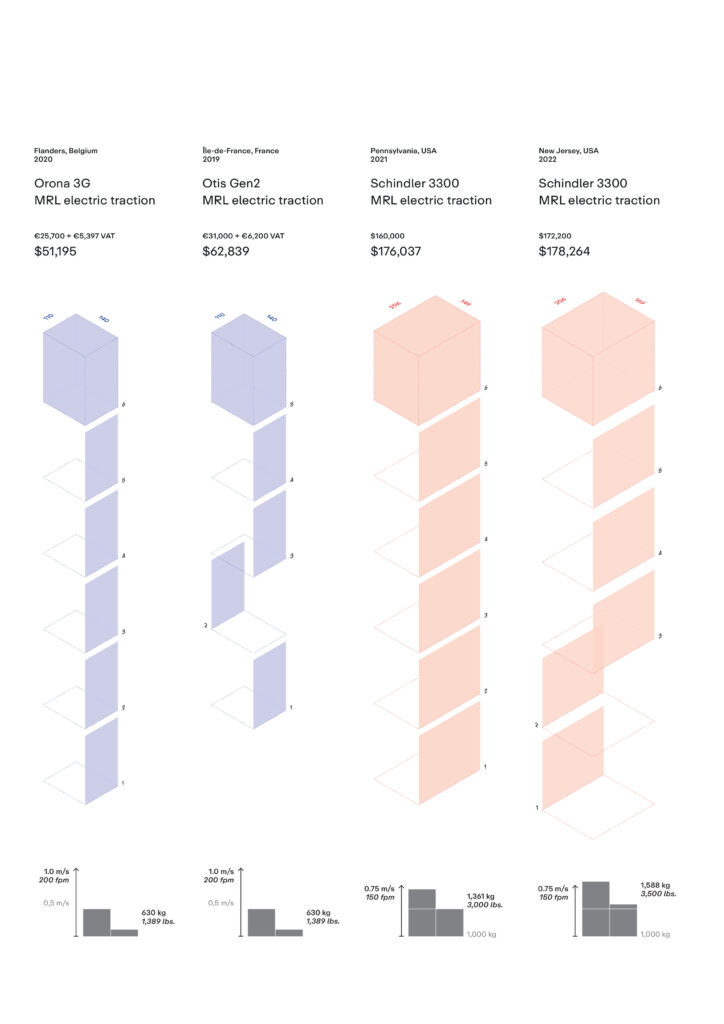

New elevators in North America cost at least three times as much as in Western Europe, after accounting for cost-of-living differences (in nominal terms, the North American cost premium is even higher). Elevators on both continents are sold as complete packages, and developers or general contractors are quoted a single fixed price that includes parts and labor, making costs easy to compare across regions. A few typical installations serve to illustrate the differences in price, which were confirmed by other proposals viewed.

In order to keep the installations analyzed as consistent as possible, only four- and six-stop elevators (plus one slightly more complicated five-stop installation from France) are presented. While high-rise elevators are the most technologically interesting and tall buildings would not be possible without elevators, most elevators in the world are in fact low- and mid-rise installations. These are also the most homogenous, with machine room less (MRL) electric traction models being most popular for these heights in both Europe and the United States (hydraulic elevators, which are an older technology that has largely fallen out of use in new installations in Europe, still have significant market share in North America, and are slightly cheaper to install, but come with higher operating costs). Elevator companies also often present a single quote for all elevators when bidding on larger projects, so taller buildings with multiple elevators complicate price comparisons.

One consequence of using mid-rise installations was that we were not able to find any Canadian proposals with enough detail to include in the comparison table. Canada has a higher housing stock growth rate than the United States, and tends to build more high-rises and larger and taller mid-rises, beyond the four- to six-stop, single-cab jobs analyzed in our table. However, figures viewed with less detail suggest that Canada is much closer to the U.S. than to Western Europe on price, with Canadian dollar-denominated costs coming in roughly equal to American dollar-denominated ones in the United States. When applying a purchasing power parity conversion, this would make Canadian examples only about 15 percent cheaper than those in the U.S.

We were also not able to find enough high-quality information for installations in high-income countries in East Asia to include any quotes in the comparison table. However, our research suggests that in South Korea, a six-stop, 16-person (roughly 2,500-lb.) elevator might cost around $32,500, or around $53,000 with a purchasing power parity conversion applied, in line with six-stop costs in Western Europe, but for a larger car.

2.2.2 Post-installation costs

Elevators are expensive to install, but most of the industry’s revenue – and therefore building owners’ expense – comes from things other than the initial installation, particularly in developed markets like Europe and the United States with low population growth. Profits are even more tilted towards post-installation services, and many manufacturers offer new installations at or near wholesale cost in order to win more lucrative service and maintenance contracts.57 As a rule of thumb, annual ongoing costs equal around 3.5 to 5 percent of the installation cost for the elevator in any given market.58

Comparing costs to operate elevators can be difficult, since the equipment is less standardized than a new installation. Costs can vary greatly depending on the age and type of elevator, the use it receives, and size-related factors. There are many different kinds of costs in owning an elevator, from predictable recurring expenses like electricity, inspection, monitoring, and preventative maintenance, to less predictable but still frequent outlays for services like repairs and disentrapments, to very high and infrequent costs like modernizations (where many components are replaced at once every generation or so). One thing that almost all of these costs have in common is that they are far higher in North America than in Western Europe.

Affordable housing developers in New York City underwrite total annual elevator operating and maintenance expenses of $7,500 per device.59 A review of actual expenses for a handful of multifamily rental, condo, and co-op buildings around New York and Washington, D.C., shows similar or slightly higher elevator expenditures, with a little over $5,000 per device going to regular maintenance contracts, and the remainder split between inspections and repairs.

Annual costs in Europe are dramatically lower. In Spain, one academic analysis put the annual cost of preventative maintenance contracts at around €900 per year, plus €300 for typical repairs.60 One German elevator maintenance company advertises maintenance contracts at €59 per month (€708 per year) for elevators with up to six stops, or a more affordable €420 per year for low-maintenance MRL models that only require one visit every six months.61 A 2010 report by the City of Paris on the French capital’s notoriously poorly maintained and un-modernized elevators (at least at the time) cited an elevator maintenance company as saying that the average annual maintenance contract cost for a condominium building was €2,000 per elevator, with France requiring service visits every six weeks.62 An independent Belgian elevator company claims that annual maintenance contracts there average a similar amount, with a separate Belgian landlord paying roughly €1,000 per year to Orona for maintenance and monitoring for each 630-kg MRL elevator in newer mid-rise buildings.63

Codes in both Europe and North America require constant monitoring of in-cab communications devices intended for entrapped riders, and these monitoring costs are often folded into general service and maintenance contracts. Regulators on both continents require telephone monitoring, but newer devices in North America must also provide two-way visual communication devices – video monitoring, screens that can display text written from within a call center, and basic input devices for riders – so that people who are deaf, hard of hearing, and mute and who don’t have working cell phones can be reassured that help is on the way after they call for it. This requirement is still being rolled out and only applies to new or modernized devices, but early indications are that it could nearly double monthly monitoring costs (see 5.3.3, “Two-way audiovisual communication,” for further discussion).

As for periodic inspections, the most intensive test required in North America is called the Category 5 (or Cat 5) test, which happens every five years (typically at the same time as the annual Category 1 test), whose scope is described in a later section titled “Alternative testing.” In New York City, one local independent elevator service company charges $2,000 for the roughly four-hour Cat 5 test (or $1,300 for the roughly two-hour annual Cat 1 test in other years), and a separate company charges an additional $780 for the required third-party “witnessing” to ensure the integrity of the test and guard against corruption. In Toronto the price is similar, with one firm advertising Cat 5 tests starting at $2,995 (CAD).64

In Europe, prices for inspections are, as usual, much lower. France’s five-year test costs around €250 before tax, and usually takes at most two hours.65 A major testing firm in Austria offers the required annual test for €280.80 (taxes included) for elevators with up to five stops.66 In Italy, testing must be done every two years, and can be carried out by either government entities or so-called notified bodies (whose responsibilities are covered in greater depth in chapter 5, “Technical codes and standards”), with prices of around €140 plus tax being typical.67

Once every generation or so, elevators must be completely overhauled, called a “modernization.” These projects can vary in scope and price, with modernizations of more recently installed elevators costing less than modernizations of older devices. Modernization costs for the oldest elevators tend to very roughly match new installations in price, with a similar disparity between U.S. and European costs.

Public procurement documents can be a rich source of modernization cost information in the United States. TK Elevator quoted a municipality outside of Denver $133,236 in 2021 to modernize a two-stop, city-owned 3,500-lb. outdoor hydraulic elevator installed over 20 years earlier that had been damaged by the fire department while rescuing an entrapped homeless person. In 2023, a Florida airport contracted with Schindler to modernize four low-rise hydraulic elevators first installed in 1989 for $540,991, or around $135,000 per device.68

The Belgian government in 2014 put the median cost of modernizing an elevator up to 30 years old at €8,000, or €20,000 for a slightly older elevator (equivalent to around $13,000 and $32,000, respectively, in 2023 after adjusting for purchasing power parity and inflation).69 One social housing operator in Paris estimated that modernizing 95 percent of its 475-device fleet of elevators would cost a bit over €18 million according to a 2010 report (or nearly $66,000 per cab after adjustments).70 A French consumer group estimated the typical modernization at €30,000 in 2018, with a different source in 2022 putting the cost at €20,000 to €50,000 per elevator.71 One German website estimated €65,000 for a substantial modernization of a 20-year-old, six-stop office building elevator.72

2.3 Work timelines

Labor is the major cost in installing and maintaining elevators, and basic rules of thumb suggest that it takes roughly twice as long to install an elevator in a new building in the United States as in Europe. In the U.S., the variable length portion of an installation requires around one week per floor of labor from a full-time, two-person crew, plus perhaps some extra time for fixed components that don’t vary according to height.73 In Western Europe, typically elevators are installed by the same crews at a rate of at least two stops per week.74

Generalizing about the time to complete a modernization of an existing elevator is more difficult given the heterogeneity of this work, but evidence points towards longer timelines in the United States, with accessibility consequences for those who depend on elevators. In Europe, Schindler cites three to five weeks for a complete replacement of an elevator, and the Berlin Tenants’ Association wrote about a case where a modernization in high-rise of well over a dozen stories was planned to take three to four weeks. The German Lift Journal put the timeline for a partial modernization in what they called a tall building at two to four weeks, or around eight weeks for a complete modernization.75 A representative from a firm in Italy specializing in modernizations said that typical modernizations of a six-stop elevator can take anywhere from just one week to, for example, replace the controller and electrical control system (including buttons), to three or four weeks to do more intensive work like the aforementioned work plus replacement of the traction motor and landing and cabin doors, while a complete replacement of an entire elevator (beyond the normal scope of a modernization) takes eight to 10 weeks.

Modernizations in the United States take about twice as long. A facility management trade publication put the typical modernization downtime at four weeks for a two- or three-stop hydraulic elevator, or 10 to 12 weeks for a high-rise traction elevator.76 One modernization consultant in Toronto put the timeline for a more intensive six-stop elevator modernization at eight to 20 weeks depending on different variables, a timeline which matches what a New York City consultant told a magazine covering homeowners associations in the region.77 Experts said that greater elevator capacities in North America make modernizations more time-consuming, and also cited increased use of preassembly and prefabrication and better-trained mechanics as possible contributing factors to quicker projects in Europe.

Compared to new installations, the modernization sector globally is more dominated by independent firms, which in North America are less likely to be unionized (or, in the case of New York City, are more likely to be signatories to the only-in-New-York International Brotherhood of Electrical Workers’ Local 3 Elevator Division, which does not impose the same restrictive work rules as the IUEC). Controllers, machines, and other components used in modernizations in North America are more likely to be sourced from independent firms which manufacture only for the North American market, as parts made for the global market and certified to European norms used globally are often not allowed to be used in North America. This more limited availability of components (see chapter 5, “Technical codes and standards”) may also contribute to longer modernization timelines in the U.S. and Canada.

2.4 Safety outcomes

In 1911, when the consolidated Otis Elevator Company was only 13 years old, Charles Otis set out to celebrate the 100-year anniversary of the birth of his late father, Elisha Otis. Otis the corporation was the largest elevator company in the world, but Elisha Otis had not been a particularly important figure in the elevator’s history up until that point. He performed a number of fairly unremarkable demonstrations of a safety device in 1854 at a World’s Fair in New York City, and the company was a minor player in the city’s burgeoning elevator market. The elevator had been invented millennia earlier, and incremental improvements had been made, often independently, throughout the United States and Europe in the 19th century. So when Charles Otis sought to commemorate his father’s birth, he could not claim that he invented the device itself, and instead related a mostly apocryphal scene at the World’s Fair involving a rapt crowd watching on as Elisha Otis cut the cable holding up the platform that he was standing on. Rather than plunging to his death, a safety device engaged, free fall was averted, and the modern safety elevator was born.78

The choice to exaggerate the World’s Fair demonstration was driven by the importance of safety in popularizing the elevator, an emphasis which remains to this day in the elevator industry and its regulation. Nowadays, elevator free falls have been mostly eliminated through redundant steel elevator ropes and the use of safety brakes like the one that Otis demonstrated in 1854, and the hundreds of millions of elevator trips taken worldwide each day pose very little risk to users.79

2.4.1 Elevator safety

Around 12,000 Americans are seen in emergency rooms for elevator-related injuries each year, according to the U.S. Consumer Product Safety Commission, but that includes incidents as minor as cuts and scrapes from tripping on the threshold. The commission does not report statistics on elevator user fatalities, as there are too few to generate an estimate based on their sampling.80

The risk of elevators throughout their history has long been to the workers who build, maintain, and work around them, as they often have to work in unprotected shafts and in other situations that do not involve the full suite of safety precautions afforded to users.81 Vertical transportation mechanics face an elevated risk of dying on the job relative to other occupations, with five workplace fatalities across a total elevator and escalator installer and maintainer workforce of 22,510 people in 2021 in the United States.82 The Bureau of Labor Statistics does not track data on the elevator occupation to directly to make proper comparisons to other jobs, but it is safe to say that elevator mechanics die on the job at much higher rate than that of the general U.S. workforce, and somewhat more often than construction workers as a whole, but at a much lower rate than roofers and structural iron and steel workers (the most dangerous construction occupations) and other dangerous non-construction occupations like loggers, fishers, and hunters.83

Just as the American construction industry as a whole is less safe than the European construction industry, with workers having a higher likelihood of dying on the job, the U.S. also appears to see more elevator mechanic deaths relative to its stock of elevators.84 From 2003 through 2020, the United States saw 74 fatal on-the-job injuries among elevator or escalator workers according to the Bureau of Labor Statistics – on average, a little over four fatalities per year.85 Relative to the total installed stock of elevators in 2020, that works out to 3.9 occupational fatalities per million elevators per year.

The European Lift Association, on the other hand, tallied an average of nearly a dozen fatal accidents per year among elevator workers across 24 reporting countries from 2013 through 2021, with only two total fatalities among escalator workers in that period.86 It is unclear which 24 countries those numbers come from, but given that the European Lift Association collects market data across 31 countries with nearly 6.5 installed elevators in 2021 – mostly in higher-income countries in Western Europe, which are more likely to collect and report occupational fatality data – it is likely that the United States has a higher occupational fatality rate for elevator workers per device than Europe.87 (Non-fatal injury data exists in both the U.S. and Europe, but different definitions and healthcare systems make the data difficult to compare.)

2.4.2 Alternative transportation safety